What Are the Rates of Return for Checking and Savings Accounts

Nov 23, 2023 By Triston Martin

With Mobile and Electronic transfer features like Biometric Authentication, Face ID, Fingerprint login, and mobile deposit, you'll experience simple, 24/7 account access, whether at home or on the road. Dividends and share distributions accrued in savings and membership accounts are disbursed once every three months. Dividends and APYs are determined using the average daily balance of the deposit. Your Intelligent checking plus account will put your money into work for you by paying you dividends. To continue receiving our exceptional dividend rate, your monthly balance must be over $700. Aside from the minimum deposit and dividends, this account is identical to our Smart Checking account. You'll have access to a Temporary residence debit card, traditional paper checks, and straightforward digital account management features.

The Rates of Return for Checking and Savings Accounts

Specifics on the Dividend Amount

The table below details the dividend rates and annual percentage yields applicable to your investments based on the most recent dividend declaration date. Based on the dividend rate and the compounding frequency that applies to the type of account being utilized, the Annual Percentage Yield (APY) displays the total amount of dividends that were already expected to be paid on an account each year. Increasing the dividend rate by both the compounding frequency appropriate for the account type results in the annual percentage yield. This rate is expressed as a fraction of the entire sum. The dividends are assumed to remain on deposit until the certificates mature, which is reflected in the Annual Percentage Yield calculation. The yield is estimated with this assumption. A withdrawal will reduce the accrued balance.

Paid Out In Dividends

Dividends are paid from the remaining earnings and income after required transfers to reserves have already been made following the end of a dividend period.

The steps involved in compounding and crediting

Standard companies, clubs, draughts, and certificate portfolios will each have their dividends generated and credited per the guidelines indicated in their individual brochures. Please feel free to enter the Credit Union and pick up some literature.

A few things to keep in mind

The minimum investment that must be kept in an account differs for each type of account. Please get in touch with the Credit Union if you need any more clarification. The dividend calculation method and the minimum guaranteed balance calculation method are based on the same principle of calculating the average balance between the amounts over the previous seven days. Calculate the average balance between the amount of an account by adding together the principal that was in the account every day during the period and then dividing by the number of days in the period. The number obtained is the account's mean balance throughout the day. The result is the arithmetic mean of the balance from each day.

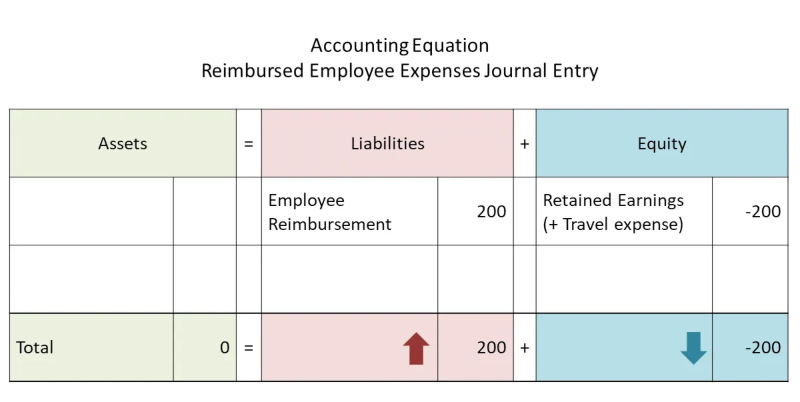

Reimbursement of Expenses from Profits

Any money you deposit into your portfolio weekly will start earning dividends immediately. This is because your dividends will be determined daily based on the amount you have in your account. Payments would start accruing on the following main day if you deposited something other than cash (any such check).

Conclusion

If you have a qualified loan, mortgage, debit card, or checking account, we will repay any out-of-network ATM fees and cover no-issue fees for Visa gift cards. Access your money quickly and easily from any device, any place, and at any time with the help of Mobile and Internet Banking tools like Touch ID, Face ID, Fingerprints login, and mobile deposit. Investors and members receive dividends and share distributions four times a year. Daily compounding of the principal amount deposited calculates dividends and interest. Your funds might earn you money with our Smart Checking Account currently. You'll be eligible for our excellent dividend rate if your average monthly deposit is $700 or more. This account's minimum investment and dividends are identical to our Smart Checking account.