How to Effectively Understand and Utilize Business Credit Risk Scores

Oct 24, 2024 By Sid Leonard

A business credit risk score is a critical tool that helps businesses, lenders, and suppliers assess a company's creditworthiness. It measures whether a business is likely to repay loans or meet its financial obligations on time. Understanding your business credit score is crucial for maintaining financial health and ensuring that your business can access loans, favorable terms with suppliers, and other financial opportunities.

In this article, we will explain how a business credit risk score works, how its calculated, and how you can use it to your advantage. Well also cover tips for improving your score and keeping it in good standing.

What Is A Business Credit Risk Score?

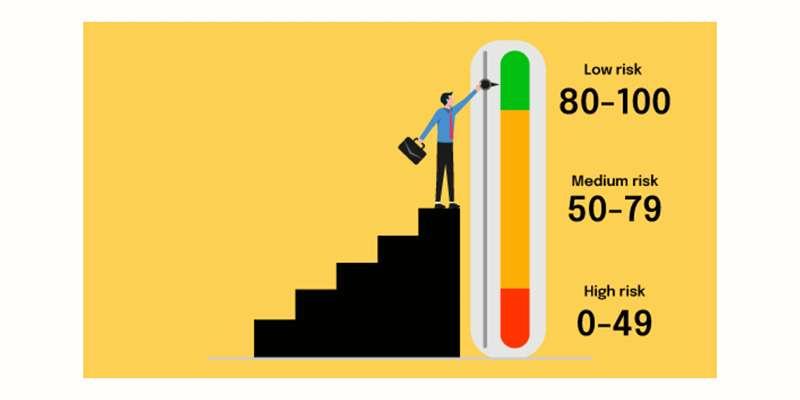

A business credit risk score is a number, usually ranging from 0 to 100, that reflects the creditworthiness of a company. It is similar to a personal credit score but applies specifically to businesses. Lenders, suppliers, and potential business partners use this score to evaluate the likelihood that a business will repay loans or pay its bills on time.

Unlike personal credit scores, which range from 300 to 850, business credit scores have a smaller range. Generally, the higher the score, the better the businesss creditworthiness. For example, a score of 80 or above is considered low risk, while a score below 50 may signal high credit risk.

Three major credit bureausEquifax, Experian, and Dun & Bradstreetcalculate and report business credit scores. Each bureau has its own method for calculating the score, but all focus on the businesss credit behavior and history.

How Business Credit Risk Scores Are Calculated

The calculation of a business credit risk score is based on several factors that reflect the financial health and reliability of a company. While the exact formula varies between credit bureaus, the main components typically include:

1. Payment History

A Business's credit score is largely based on how well it has paid its debts in the past. This checks whether a business pays its debts and bills on time. If you pay late, miss payments, or fail, it can hurt your score a lot. A Company's score goes up when it consistently pays its bills on time, which shows lenders and sellers that the business can be trusted.

2. Credit Utilization

If a business has credit available, how much of it is being used at any given timeis called credit usage. If a business uses a lot of its credit, it could have money problems, which will hurt its credit score. To keep a good credit score, you need to keep your credit utilization ratio in a healthy range, usually below 30%.

3. Legal Filings and Public Records

Public records such as tax liens, bankruptcies, and court judgments can negatively impact a business's credit score. If a business has been involved in legal disputes or financial issues, these records are factored into the score calculation. Its important to avoid legal issues and resolve disputes promptly to prevent them from harming your score.

4. Demographic Information

Credit bureaus also consider demographic information about a business, such as its size, years of operation, and industry. Generally, businesses with longer histories and stable financials are considered lower-risk borrowers.

The Importance of a Business Credit Risk Score

Maintaining a strong business credit score is crucial for several reasons. A high credit score can provide access to favorable financing options, better terms with suppliers, and stronger business relationships. Heres why your business credit score matters:

1. Access to Loans and Financing

A high business credit risk score increases the likelihood that a business will qualify for loans with favorable terms. Lenders rely on this score to assess whether the business is a safe bet. With a strong credit score, a business is more likely to receive lower interest rates and higher credit limits.

2. Building Supplier Relationships

Suppliers and vendors also check a companys credit score before extending trade credit. A higher score can help secure better payment terms, such as longer payment cycles, allowing the business more flexibility to manage cash flow. In contrast, a lower score might result in stricter payment terms, such as requiring upfront payments.

3. Attracting Business Opportunities

When a business is seeking to collaborate with new partners or clients, a strong credit score serves as proof of its financial stability. Potential partners may view a high credit score as a sign of trustworthiness, opening up new business opportunities.

How to Improve Your Business Credit Risk Score

Improving your business credit score takes time and consistent financial management. Here are some steps to help raise your score:

1. Pay Bills on Time

If you want to keep your business credit risk score high, the most important thing is to pay your bills on time. make sure you pay all your bills on time, whether credit card bills, invoices from sellers, or loan payments.

2. Monitor Your Credit Utilization

Do not use all of your available credit, as this will lower your credit usage ratio. When you use credit, try to use less than 30% of it. Regularly using less credit than this amount will improve your credit score.

3. Check Your Business Credit Reports Regularly

Its important to regularly review your business credit reports to ensure the information is accurate. Errors can happen, and if incorrect information is reported, it could harm your score. Dispute any inaccuracies immediately with the credit bureaus to correct them.

4. Establish Trade Credit with Vendors

Work with vendors and suppliers that report trade payments to the major credit bureaus. This ensures that your good payment habits are recorded and reflected in your credit score. Regular, positive trade credit reporting helps boost your score over time.

5. Avoid Legal Issues

Negative public records, such as lawsuits or tax liens, can lower your business credit score. Its important to resolve legal disputes promptly and avoid financial trouble that could lead to judgments or liens.

The Impact of Negative Data on Your Business Credit Score

Unfortunately, negative information on your business credit report can linger for several years. For instance, bankruptcies can remain on your report for up to nine years and nine months, and tax liens can stay for up to six years. Other types of negative data, such as collections or judgments, may also impact your credit score for several years.

Its important to stay informed about whats on your business credit report and work toward resolving any issues that could harm your score. While negative data can stay on your report for years, consistently paying bills on time and managing your credit well can help offset these impacts over time.

Conclusion

Understanding and managing your business credit risk score is essential for financial success. Whether youre looking to secure a loan, build strong supplier relationships, or grow your business, a high credit score can open many doors.

By paying bills on time, keeping your credit utilization low, and monitoring your credit reports regularly, you can maintain a strong credit profile. In addition, working with vendors that report payments to credit bureaus and avoiding legal troubles can help you build and protect your business credit score.

With a proactive approach, you can ensure that your business credit score remains a valuable asset. This will allow you to access better financing options, establish strong business relationships, and seize new opportunities for growth.