All About: What Is Key Person Insurance?

Feb 23, 2024 By Susan Kelly

Introduction

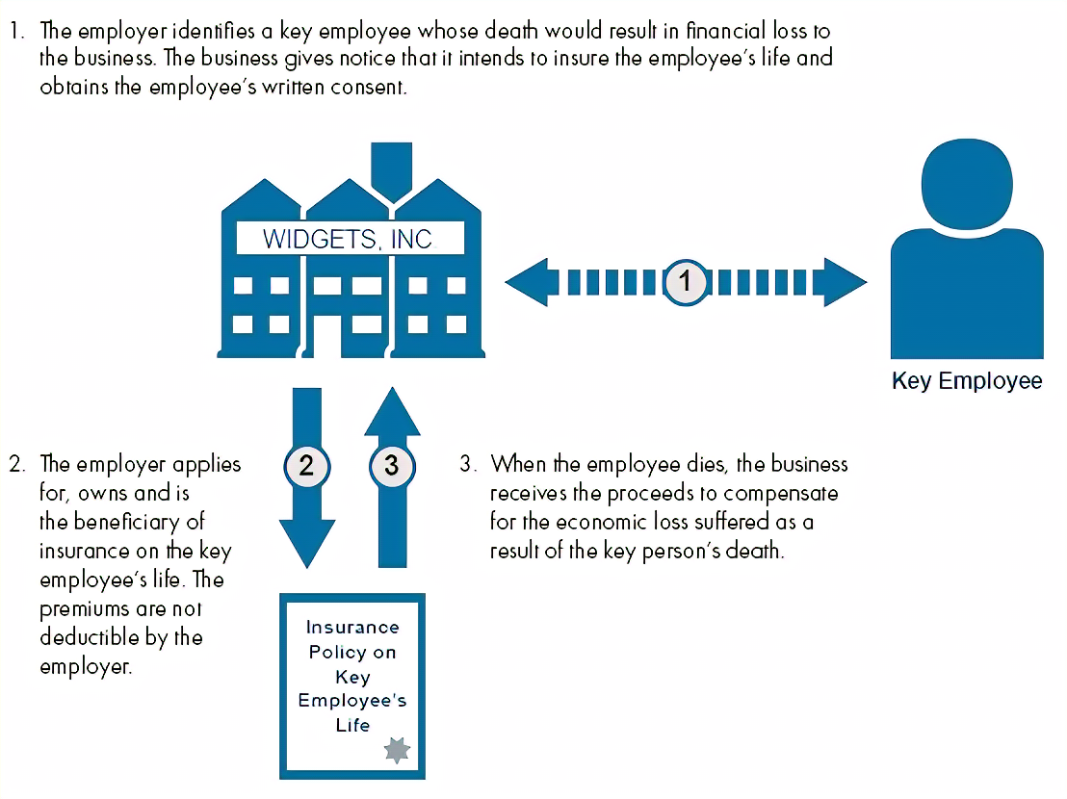

What Is Key Person Insurance? Partners, key employees, and irreplaceable business owners should each have their own life insurance policies. The company itself will receive benefits from the policy. The company has purchased a key person insurance policy. It takes over as a beneficiary and pays the premiums. This is a significant difference compared to other types of insurance, such as life or disability. In the event of the employee's untimely demise, the insurance company will make a payment to the company. The money you receive from an insurance claim can be used. Debts must be repaid, operating costs must be covered, revenue must be replaced until a suitable replacement is found, and, in the worst-case scenario, investors must be paid back, severance packages must be distributed, and the business must be shut down systematically.

Key Person Insurance: The Process

It is common practice for businesses to insure the lives of their most valuable employees. The company foots the bill for the insurance, and the worker is listed as the recipient. In the event of a death in the business, the policy's death benefit will be paid out.

That sum can be put toward advertising for, hiring, and training a suitable replacement. In the event of the company's insolvency, the funds could be used to settle debts, pay off investors, settle severance agreements, and wind down operations systematically. There are alternatives to filing for bankruptcy for the company. The option of key person insurance exists.

If a company is debating whether or not to purchase this insurance, its top brass should think about who its immediate priorities are. The owner of many small businesses also doubles as the company's chief financial officer and client liaison. If this person doesn't oversee operations, the company might have to close its doors immediately.

How Can You Decide Who Has To Have This Insurance?

Consider the short-term needs of your company and hire accordingly. One common form of small business organisation is the sole proprietorship. He may be in charge of overseeing major clients, maintaining fiscal stability, and resolving employee concerns. If that person leaves, there will be no more business.

What Amount Of Key Person Insurance Do I Need?

However, regardless of the nature of your enterprise, you should invest as much as you can reasonably afford. Check the prices of multiple brokers. The majority of life insurance agents will offer you key person coverage. Try getting some term life insurance. Whole life and variable life policies are more expensive, but many agents will try to sell you one anyway because of the higher commissions they pay. Contrarily, these are not required for a key person policy. Estimates on sums of $100,000 and $275,000 should be sought. Review the prices for sums of $500,000, $750,000, $750,000, $1,000,000, and $750,000. After that, calculate how much money your business would need to stay afloat without the essential worker. Then, catch up so that the company can resume normal operations. It's important to find a policy that fits your budget while covering any urgent financial obligations.

What Are The Best Times For A Company To Consider Key Person Insurance?

- When a business seeks financing from investors or banks, this insurance is often a prerequisite. In the event of the policyholder's death, the "collateral assignment" policy will first pay off the loan and then go to the company. A company may want to purchase key person insurance for various other reasons.

- If the company bears the name of the founder, president, or another influential individual (for instance, a former or part owner),

- One's credibility, expertise, or ability to pay are all important ties to the business's success. If they take a hit, it could not be good for business.

- If a key employee leaves, it could have a negative impact on the company's bottom line or sales.

- If you own a small business and want to leave enough money for your heirs to settle any outstanding bills and shut down the company, you may want to consider purchasing life insurance.

- Each partner may seek capital to acquire the other's stake in the business if the partnership is structured as a corporation. Most partnerships do this through a buy-sell agreement.

Insurable Losses

Key person insurance protects against two main hazards:

- You can get compensation.

- The business can direct efforts toward this revenue-generating goal to prevent financial ruin.

- If income drops, expenses will rise along with it, and so will profits.

- One who contributes greatly to the happiness of others

- Profitability of the business

- Some examples of financial targets are Price tags associated with training. There has been a downturn in profits or sales. Negative debts.

- Investments serve a dual purpose: first, they help the company grow, and second, they shield it from

- Provision of funds in the event of death or incapacity

- Increase the value of the investment greatly.

- The business.

These are some examples of uses for capital:

Payback company debt. The integrity of one's credit rating needs to be safeguarded. Safeguard against a dwindling reputation. You can hedge against the potentially disastrous loss of a key supplier.

Conclusion

To cover the loss of a key employee or executive, a business may invest in key person insurance. The need for this type of insurance arises when the loss of a key employee would have a catastrophic impact on the company's ability to continue operating. The primary person in charge of a small company is often the founder or owner. If the insured person dies, the company will assume responsibility for paying the policy's premiums.