Review of BECU

Oct 26, 2023 By Triston Martin

How to Sign Up for Internet Banking

The following items are required to enroll in Online Banking:

Identification number for the account (referred to as "Member Share Account Number")

Acknowledged surname

Birth Date

When you first opened your account, you were given an account number. You will be able to sign up once you know your account number. Do you need to know your telephone number? We can search it up for you if you phone us at 1-800-233-2328. Every member of a joint checking account should have their own Online Banking profile. Please don't allow anyone else to use your username and password for the account's security sake.

The Goods and Services It Offers

Pay in money orders

Send in your payments

Send Money

Make plans for spending and keep tabs on them.

Face ID and Touch ID

Discover a BECU branch or surcharge-free ATM

Examine financial records and account balances

Prearrange Meetings

Preparing for Old Age

To what extent will your savings need to grow before you can retire? What are your intentions? How long will your retirement savings last? By seeing a financial expert, you can plan your next moves and estimate how much money you will need to save.

On the Brink of Retirement

Did you know that recent polls show the average American needs to put away more money for retirement? In the run-up to retirement, it's important to calculate when you can stop working, how long your nest egg will last, and what kind of lifestyle you can expect to have. For this reason, we make it our business to get to know you and your objectives thoroughly so that we can help you find, create, implement, and track a set of financial plans and investments that takes them into account. With our systematic five-step methodology, we can build a solid foundation for your future finances.

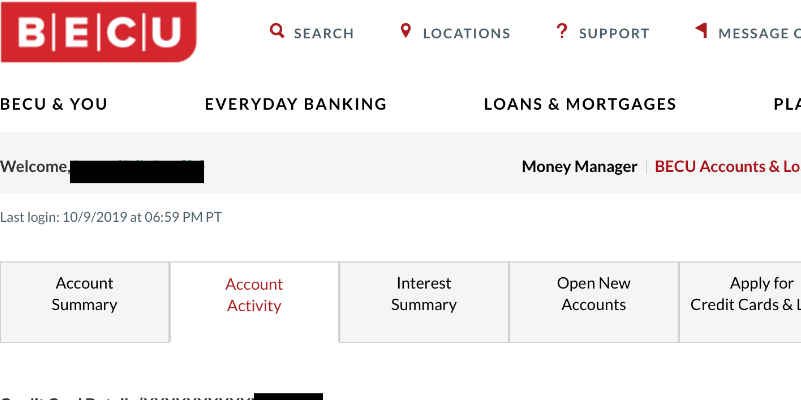

Is there an online banking option at BECU?

BECU members can conduct their financial transactions from the comfort of their homes, thanks to Online Banking and a mobile app. More banking tasks can be completed without leaving the house or using the phone when you bank online or through a mobile banking app. As a BECU member, consider these convenient ways to handle your finances without leaving the house.

Money-Saving Program for Businesses at BECU

Several different business savings accounts are available from BECU. Interest rates and no maintenance costs are two benefits of the Business Member Share Savings Account. For those looking for a more stable rate of return over the long term, BECU also provides fixed-rate CDs and money market accounts with minimum balances of $10,000.

Getting a Loan from BECU

Lines of credit (LOCs)5, term loans, and affordable equipment financing are all part of BECU's business loan package. These options make it easier and faster for business owners to secure the funding they require. In addition to the BECU business credit cards, the company offers specialized commercial real estate loans for corporations who need to buy or refinance buildings and other properties.

Business Enterprise Credit Union

BECU provides a wide range of services tailor-made for enterprises of all sizes. Among these are:

The simple application process, low necessary opening deposit, and absence of ongoing service charges for most accounts.

There are no monthly account maintenance fees and low transaction fees.

With BECU's free mobile app, you can easily access your accounts from anywhere and manage them.

Credit cards for businesses BECU has a variety of company credit cards available, each with enticing perks and low-interest rates.

BECU's Mobile and Online Banking Services

Access your account from anywhere with BECU's convenient online and mobile banking capabilities. The mobile app provides access to several services, including remote check deposits, bill payments, and transfers, while the website is user-friendly and straightforward. If you have questions about your BECU account, you can contact a customer service representative anytime.

Which Is Better: A BECU Business Account or a Wise Business Account?

Wire transfers from BECU cost $35, while those made to BECU are free. The Wise Business account provides access to various transfer options, each with its associated fees, processing times, and other considerations. For instance, wire transfers through Wise Business cost only $4.14.

Sending and receiving non-wire transfers in USD, EUR, GBP, CAD, and more is free when you use Wise Business for your international business needs. Why? Why? You obtain information on a local bank account for free. Wise's mid-market exchange rate is competitive so that you may pay freelancers and vendors at a favorable exchange rate.